Abandoned – a term that strikes fear and pain.

In addition to the emotional distress incurred by an abandoned spouse or one in the midst of a messy divorce, the Internal Revenue Service strikes you as ineligible for many credits and deductions when you file your income taxes as married filing separately.

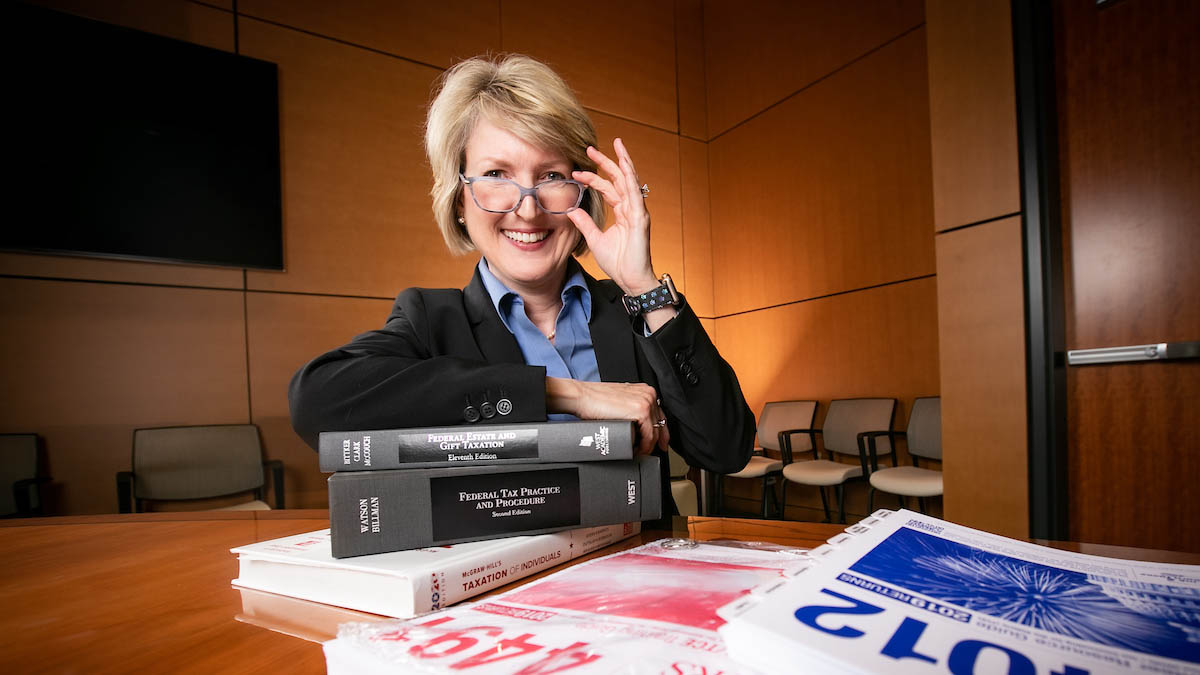

“There’s a myriad of tax benefits that are automatically lost the moment someone selects married filing separately,” said Dr. Kerri Tassin, assistant professor of accounting at Missouri State.

Making it fair

In 2018, Tassin won the Outstanding Paper Award from the American Accounting Association for a piece she submitted to the Journal of Legal Research.

In it, she outlined many inequities she saw in current tax codes. Then, she proposed alternate policies that would be more equitable for tax payers.

Few accountants, Tassin said, would be familiar with every state and federal statute. That’s why part of her policy proposal is to clarify the language “so there are no ugly surprises later,” she added.

“My heart is working with taxpayers in clinics,” she said. The work is an alignment of her goals and passions. “I want to remove some of the fear and uncertainty.”

Leave a Reply