This post was written by Malayna Koetting, an undergraduate student majoring in psychology.

Due to the rising number of Baby Boomers about to hit the older adult population, it is important to gain a better understanding of Medicare. Here are some common misconceptions and helpful hints about how Medicare works.

Medicare and Medicaid are the same thing.

False! Medicaid is actually an insurance program funded by taxes (federal, state, and even local taxes). Its rules and regulations are put forth by the state, and every state has different regulations regarding Medicaid. Meaning, some states can be very generous, and some states can be very stingy (which is why it is important to research candidates and vote!). This program is mainly benefited from by people who have low income, but it also helps those who have a disability or those who need to stay in an assisted living facility.

Medicare on the other hand is federal funded. Rules and regulations for Medicare are put in place by the government so that it is the same in every state. Medicare is funded by payroll taxes. The individuals who benefit the most from this program are: older adults who are 65 years and older, those who are in the end stages of renal disease, and sufferers of Lou Gehrig’s disease. However, people with disabilities benefit from this program as well. A good way to remember the difference is that Medicaid aids the poor, while Medicare cares for the older adults.

Medicare is going to run out of money.

It is true that people are starting to live longer and healthier lives, thanks to medical advances. Thanks science! However, it is false that Medicare will run out of money. While it is a common belief that older adults are frail and have many health problems, the reality is that most older adults are living healthier lives. Because older adults are living such healthier lives, there is less need to use Medicare benefits.[1] There are certain unavoidable conditions that occur with aging, however most of these conditions cost very little and are manageable. In fact, the largest costs that older adults make are when they need more intense care such as when living in an assisted living facility or in-home help and care. Neither of these types of needs are generally covered by Medicare, so it is safe from the stress made by these two issues.

Medicare covers every health expense.

If only! Medicare does not cover all health expenses.[2] Medicare part A covers hospital type care. This includes stays in the hospital, staying in a nursing facility, staying in a nursing home, hospice, and some home health services. Even though these areas are covered, Medicare only covers the basic needs. For example, if a person is staying in the hospital after having surgery, the room is covered but only if it is a semi-private room. As well, the semi-private room will not include a television, or even a telephone. Talk about a fun stay at the Radisson.

Part B of Medicare covers Medical services such as doctor visits. However, Medicare only includes the basics. Some examples of things not covered would be medically unnecessary surgeries, or cosmetic surgeries. Sorry guys, the nose jobs aren’t covered by Medicare. Medicare Part D helps cover medication costs. However, the individual has to pay a premium every month.

Finally, part C of Medicare is a combination of part A, part B, and part D. Part C allows the person to gain a little more control and pick their own plan from a private agency, however these plans must be pre-approved by Medicare. Likewise, the individual has to go to doctors and hospitals within the Medicare network, otherwise their expenses won’t be covered. So, is it truly more control, or that they let you think you have more control?

Medicare is automatic, and auto-magic.

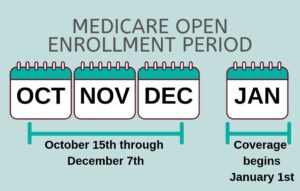

Just like most things in this world, you have to put in a little blood, sweat, and tears. People are not automatically enrolled in Medicare.[1] In fact, there is even an enrollment season starting in mid-October and going until early December. This is the perfect time to compare price health care plans and to see if changing plans could save you money! (and if you aren’t shopping savvy there are individuals that you can contact to help you find the right plan for you within the community.) These changes take effect the first day of the following year. New year, new me, new healthcare plan. You can only enroll for Medicare (if you are eligible) when you turn 65 years old. More specifically, 3 months before the month of your 65th birthday and 3 months after the month of your 65th birthday, as well as your birthday month.[2] Talk about a fun birthday activity!

Just like most things in this world, you have to put in a little blood, sweat, and tears. People are not automatically enrolled in Medicare.[1] In fact, there is even an enrollment season starting in mid-October and going until early December. This is the perfect time to compare price health care plans and to see if changing plans could save you money! (and if you aren’t shopping savvy there are individuals that you can contact to help you find the right plan for you within the community.) These changes take effect the first day of the following year. New year, new me, new healthcare plan. You can only enroll for Medicare (if you are eligible) when you turn 65 years old. More specifically, 3 months before the month of your 65th birthday and 3 months after the month of your 65th birthday, as well as your birthday month.[2] Talk about a fun birthday activity!

Hopefully these myths and facts have helped you to gain a better understanding of one of our nation’s major programs for older adults. Since the older adult population is going to be experiencing a large increase in the not-so-distant future, it is important to be educated not only for oneself but for others, as an advocate.

References

- Haass, D. (June 25, 2018). Busting Five Myths about Medicare. Retrieved from: https://www.forbes.com/sites/forbesfinancecouncil/2018/06/25/busting-five-myths-about-medicare/#38a53a0c771e

- 5 Myths About Medicare Dispelled. (2012). Retrieved from: https://www.nextavenue.org/medicare-myths-and-realities/

- Williams, S. (2016). The 7 Most Common Medicare Myths. Retrieved from: https://www.fool.com/retirement/2016/09/24/the-7-most-common-medicare-myths.aspx

- Part A & Part B sign up periods. (n.d.). Retrieved from: https://www.medicare.gov/sign-up-change-plans/how-do-i-get-parts-a-b/part-a-part-b-sign-up-periods