Reading between the data

This is a question Dr. Seth Hoelscher poses to his students when he is teaching investments and disclosures.

“You’d give money at a better rate to the one you have more information on,” he said.

Hoelscher, assistant finance professor at Missouri State University, was working toward his MBA at West Texas A&M University when the financial crisis of 2008 hit. As many people lost money during the recession, he decided to learn as much as he could about finance and investments.

Now he teaches the subject while researching commodity markets, disclosures and corporate finance. In 2019, he received the College of Business award for Best Empirically Based Research Paper. He’s published over 19 articles and written financial advice for sites like WalletHub.

What influences investors

Many of Hoelscher’s articles focus on voluntary disclosures. Such disclosures involve a company releasing information beyond the requirement of the Securities and Exchange Commission.

Disclosures include information about a company’s financial operations. They can include both positive and negative news, data and operational details that affect business. Investors then use this information to shape their expectations for a company.

“We try to solve answers in the literature.”

Hoelscher pairs standard empirical data with hand-collected data from financial disclosures to determine what certain industries do and do not disclose voluntarily.

“Disclosures tell us how the company is operating and if or how they are managing risks,” he said. “It also tells the investment community more about the future prospects of the industry as a whole.”

The information helps investors understand a company’s future cashflows and profitability. This knowledge ultimately affects where investors put their money.

Disclosures also can positively affect a company’s reputation in the marketplace. This usually translates into increased market share and customer loyalty.

For example, consumers who know why prices go up and down in certain industries may feel better about investing in certain companies within those industries.

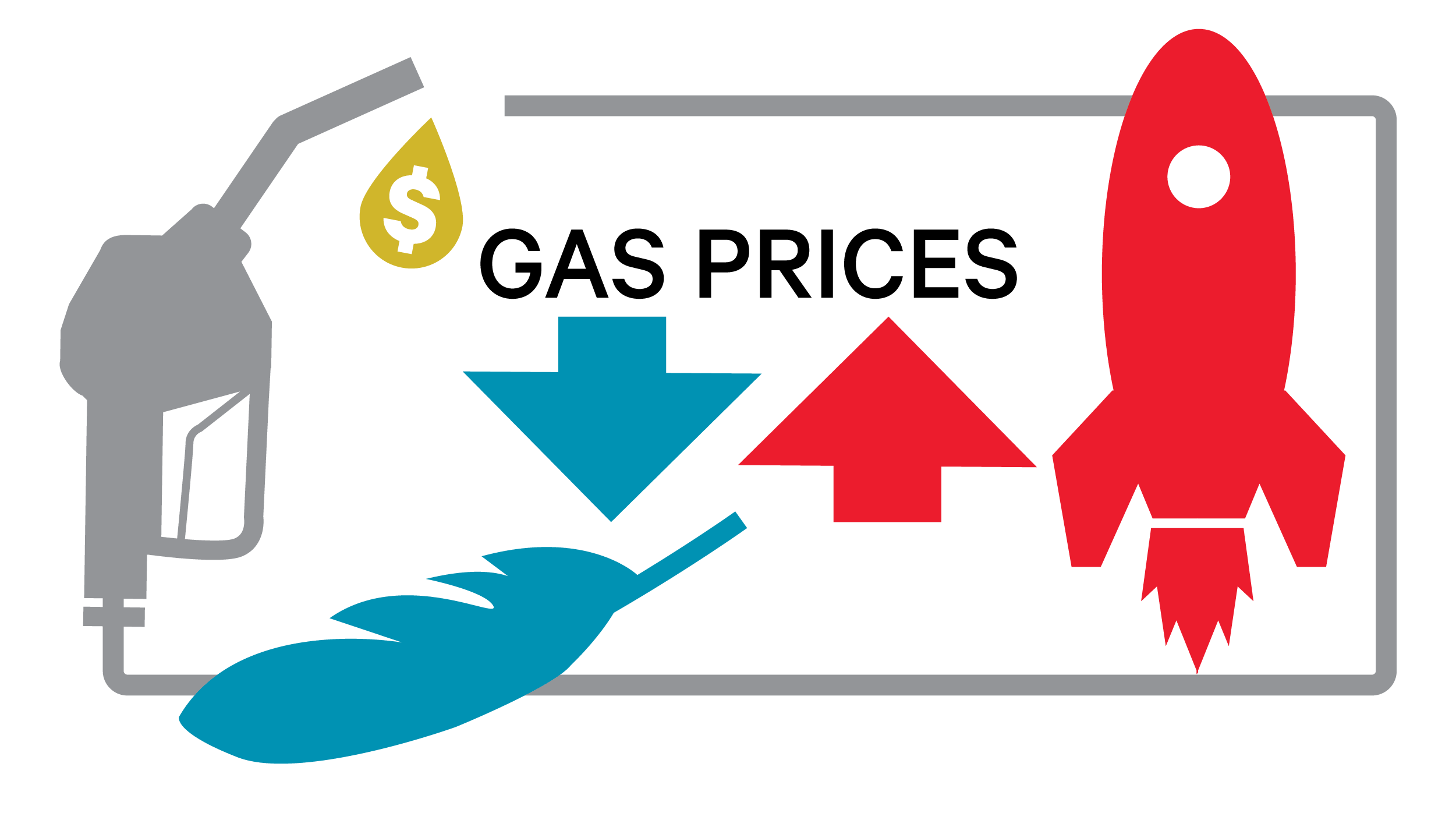

When oil prices rise, gasoline prices skyrocket. When oil prices drop, gasoline prices drop slowly, like feathers.

Rockets and feathers

One industry Hoelscher studies is petroleum and crude oil.

He surveyed literature to assess how petroleum prices respond to increases versus decreases in oil prices.

“This is a phenomenon referred to as ‘rockets and feathers,’” he said.

When oil prices rise, gasoline prices rise quickly as well — like rockets — to reflect the change in prices. However, when oil prices drop, gasoline prices drop at a slower rate — like feathers.

“One item that makes the oil and gas industry unique is the large up-front capital costs to find, drill and extract the crude oil,” Hoelscher said. This affects supply, but not demand, which can create interesting price fluctuations.

For example, in 2020, COVID-19 caused a significant and prolonged downturn in oil prices.

“While reduction in travel and increased remote work didn’t affect the supply side, it did affect the demand side,” Hoelscher said.

Large price swings in an industry like this may lead to questions of speculation and price manipulation.

“You cannot simply increase or decrease crude oil production in the short term to match the current demand. It is not like turning on and off a faucet.”

However, the empirical evidence Hoelscher surveyed shows speculation does not increase volatility in petroleum product prices.

“Ultimately, consumers can feel assured that speculation is not driving changes to the price they are paying,” he said.

Asking the right questions

Financial research presents unique difficulties. Most researchers use the same databases to collect their information.

“You have to ask, ‘how can I go about answering a question that hasn’t been answered? Or how can I answer a question from a different perspective?’” Hoelscher said.

He emphasizes this process when advising students at MSU.

“It’s great for students to learn how to justify their assumptions when presenting reports and research,” Hoelscher said. “Because it’s something that they’ll most likely continue to do in their careers.”

Hoelscher knows he will have to continue asking the right questions to find new perspectives in his work.

“Because it’s a social science, you can’t control every aspect,” he said. “But you can be creative to come up with new ideas and approaches.”

- Story by Kristina Khodai

- Photos by Jesse Scheve

Good advice

Outstanding!!