TL;DR: You can file your tax return for free, employers have already mailed you important things, and you should keep copies of everything for 3 years.

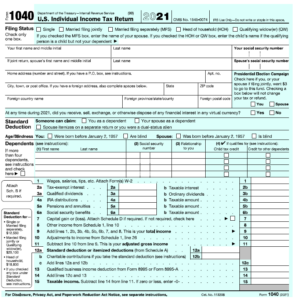

Filing Your Tax Return is Free

Let’s start with the actual tax return. To file your return for free, check out your local Volunteer Income Tax Assistance (VITA) program. These trustworthy volunteers are annually certified by the IRS to complete simple federal and state tax returns using professional software.

If you must do things yourself, the IRS has free filing services. 1040Now and EZTaxReturn claim to offer free federal and state filing for the most people.

Certified tax professionals can help with complicated returns, but even self-employment, retirement, and stock trades are usually not too complicated. If you are not comfortable filing your own tax return, check out a VITA service. If you do enlist professional help, make sure they are tax-certified, which means they (hopefully) have good tax training.

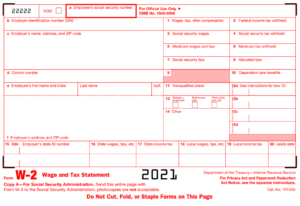

What Are W-2s

All employers send you a summary of your 2021 earnings by February called a W-2. Count the number of jobs you had in 2021. You should have that same number of W-2s. You need these to file your tax return.

If you worked under a contract (music performing or a skilled trade, for example), then you may get a 1099-NEC in the mail instead of a W-2.

If you did not receive a W-2 or 1099-NEC from your employer, contact them and request that they send you one.

Tax Records Need to be Kept for 3 Years

Immediately print a copy or save a PDF after your return is filed. Copy or scan all W-2s and 1099s. Many DIY filing services won’t let you access your tax return after few months, and if you need a tax document in the future, getting it from your former boss or from the IRS is very tricky.

Keep your 2021 tax documents until 2025. The IRS recommends keeping tax records for at least 3 years after the return is filed, and longer for some people. Remember that the FAFSA uses tax information that is a few years old, so you will thank yourself in 2023 if you need to turn in 2021 tax documents to your financial aid office.

~OSFA